Scholar Richard Auty first coined the phrase ‘resource curse’ in 1993 to illustrate the confounding nature of the relationship between natural resource abundance and under-development. Intuitively we expect that natural resources would provide the bedrock for development. To the contrary, empirical evidence suggests a strong correlation between natural resource wealth and poor development outcomes, at least since the early 1970s. For instance, where resource dependency – the proportion of a country’s resource exports as a proportion of total imports – is high, the curse abounds: Corruption; widespread poverty; a lack of human development; undermined media freedom; premature de-industrialisation; civil war and authoritarian rule are among some of the key manifestations.

Analytically, it is of course impossible that resources in themselves – by some kind of geographic predestination – are responsible for under-development. What determines catastrophic outcomes is how resource rents are acquired and distributed in any given political economy context. In other words, institutions matter. Institutions are the social systems – beliefs, norms, culture and values – that motivate regular human behaviour. If institutional constraints on the exercise of elite power are strong, resource wealth can be harnessed for the benefit of citizens. Norway, with long experience in managing its petroleum resources in a way that promotes sustainable economic growth and Norwegian welfare, is the oft-used example. In the absence of such constraints, however, elites tend to appropriate resource wealth to cement the bargain at the heart of their ruling coalition. This is why oil wealth tends to correlate with authoritarian rule, which has its own set of anti-development dynamics.

Intuitively we expect that natural resources would provide the bedrock for development. To the contrary, empirical evidence suggests a strong correlation between natural resource wealth and poor development outcomes, at least since the early 1970s.

Consider Angola, for instance, Africa’s second largest oil-producer. For 38 years, Jose Eduardo dos Santos acquired oil rents and distributed them to his inner circle at the expense of the country’s development, even after the end of the civil war in 2002 when opportunities for development were ripe.

Luanda residents queue with their cars at a gas station in Luanda, Angola. Angola’s fuel shortages, the last wave of which was in 2019, are a bitter irony for one of Africa’s leading oil producers. Photo: Ampe Rogerio/AFP

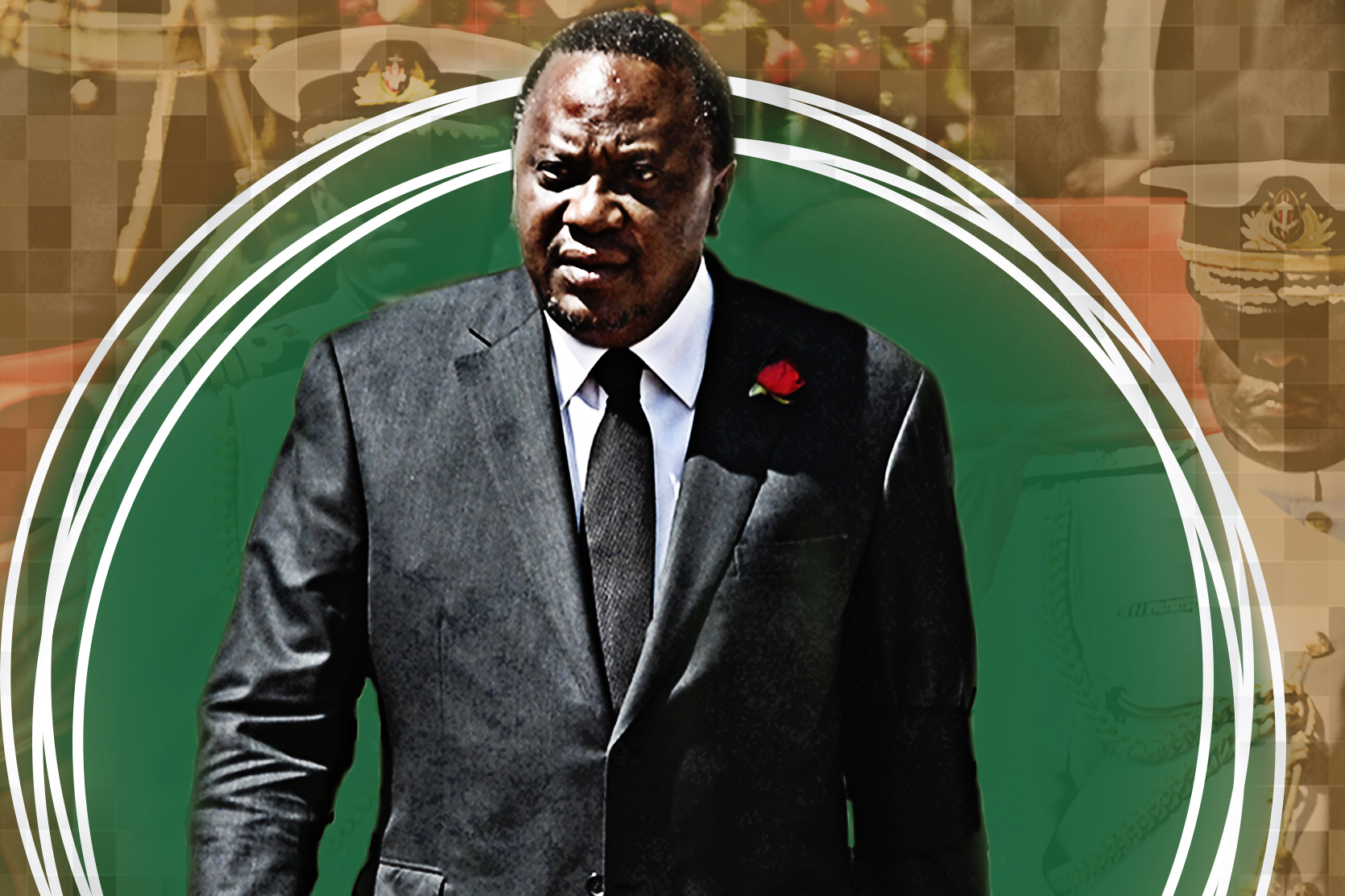

Or consider Zimbabwe, one of the most mineral-wealthy geologies on the planet. While the majority of citizens now live in desperation and squalor, elites extract mineral resources to fund their lifestyles and mete out repression against any hint of rebellion. The military forms joint ventures with external companies, for instance, which sell the products, while they control resource extraction activities at home. In South Africa, the state-capture era saw former President Zuma’s allies using state-owned enterprises to channel cash to Gupta-owned companies or abusing state influence to persuade existing operators to sell their mines to Gupta-connected entities.

In short, the political calculus of elites in weakly institutionalised resource-wealthy states is that repression is less costly than reform. And the stronger the ruling coalition becomes, the more difficult it becomes for citizens to engage in effective collective action.

Consider Zimbabwe, one of the most mineral-wealthy geologies on the planet. While the majority of citizens now live in desperation and squalor, elites extract mineral resources to fund their lifestyles and mete out repression against any hint of rebellion.

Evidently, then, reversing the resource curse is a complex matter. It is good and well to argue that better governance is required to overcome institutional weaknesses. At Good Governance Africa, we exist because we believe in the power of better governance to achieve improved development outcomes. Convincing citizens to act collectively to demand those reforms is difficult work, however. Persuading elites that reform in the direction of stronger institutional constraints is in their best long-run interests is even more difficult.

The good news, however, is that none of this is impossible. Citizens across the world should have an interest in how resources are extracted. Why? Because when you purchase an Apple smartphone, or a solar panel to power your inverter, you should care about where the mined ingredients of those devices come from. Is the cobalt in your electric vehicle ethically sourced? How sure are you that it’s not funding militia activity or warlordism?

When you purchase an Apple smartphone, or a solar panel to power your inverter, you should care about where the mined ingredients of those devices come from. Is the cobalt in your electric vehicle ethically sourced?

The world will require a significant volume of minerals and metals over the next few decades as we make the global transition towards a low-carbon economy. Electric vehicles, smart devices and renewable energy require cobalt, lithium, magnesium, chrome, copper, gold, iron ore and many others. Increasingly, these minerals and metals will only be available in sufficient quantities in institutionally fragile countries such as the Democratic Republic of Congo (DRC), Zimbabwe, Guinea, Angola, Mozambique and so forth.

The purpose of this blog campaign is to draw attention to the ‘resource curse’ and explore its specific anatomies in different contexts. Most importantly, it analyses how the curse can be reversed to catalyse broad-based development. What role can and should the private sector play? What can civil society plausibly do to stand up to corrupt and powerful elites? What can more conscience-driven global consumerism achieve?

First off, we will be hosting an epic webinar titled “Mining in Fragile Jurisdictions” with six of the world’s leading thinkers on the subject.

Thereafter, we will be hosting blog posts from invited thought leaders, along with a number of podcasts and short videos.

As always, we want to hear from you and look forward to engaging with you.

This interview reminds us of a few very important issues: 1. The role of companies. They may not be elected like governments are, but they are probably better governed (or ‘policed’) by their stock exchanges and their shareholders. 2. The role of communities to be informed and to have a say (FPIC, etc.). However, should a local community have the right to block development of a project that might benefit the entire country? and 3. The information asymmetry. Community members and citizens tend to have less knowledge about the technicalities and economics and environmental impacts, etc., than companies do. (And companies may not know enough about community fears and hopes.) The “solution” is not clear or easy, but it HAS to include total transparency, not only sharing of information, bit also explanation and discussion, etc.

Dear Ron, thank you so much for engaging with us here. Great questions in each. I’ll be writing an article soon that tries to address some of them.

What role could beneficiation of resources have and how could this be successfully implemented if appropriate