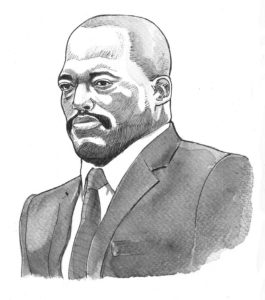

Former South African president Jacob Zuma appears before the Commission of Inquiry into State Capture on July 15, 2019 in Johannesburg, where he faces tough questioning over allegations that he oversaw systematic looting of state funds while in power. Zuma struck a characteristically relaxed tone ahead of his televised appearance, which could last for five days, tweeting a video the day before of himself dancing and singing “Zuma must fall” before laughing heartily. Wikus DE WET / POOL / AFP

Former colonisers and their multinational companies collude with Africa’s corrupt elites to facilitate looting, but both are under increasing scrutiny

Africa’s oligarchs think they have perfected the art of looting.

They neutralise the agencies of governance so they can channel the nation’s money into labyrinthine circuits that lead to bank accounts in tax havens.

But they are wrong: they are coming under increasing scrutiny, as are the banks they use.

The Plunder Route to Panama, a report published by the African Investigative Publishing Collective (AIPC) on their website in October 2017, examines how money is extracted from Africa’s citizens and transferred to tax havens abroad.

It examines seven cases of illicit outflows, all of them put into motion by heads of state or senior officials. Concerns about illicit flows have recently been receiving attention from the African Union and the United Nations, among others, with much of the blame falling on multinational companies. The AIPC report focuses on African leaders who use state resources and security apparatuses to make illicit transfers.

The AIPC report focuses on governance, demonstrating how a deliberate lack of accountability facilitates the flow of loot. There are variations, but a pattern is discernable in each case: the presidency gives leaders access to tax revenues, which they are able to divert by appointing loyalists to key administrative positions.

Lack of accountability leads to a failure of the justice system, and anti-corruption activists are silenced, hounded out or assassinated. Corrupt leaders link up with large conglomerates to divide the spoils and send money to tax havens.

Some, such as South African president Jacob Zuma, even relinquish sovereignty to facilitate theft.

Former President of South Africa, Jacob Zuma Illustration: Vusi Malindi

Australian authorities are investigating one of the family’s former companies, Australia-based Getax, for bribing politicians on the island of Nauru, the largest producer of phosphate. Gnassingbé is in his third term and Forbes estimates he is worth $4.5bn.

In Mozambique, a circle of generals from the ruling party, Frelimo, control all mining, especially of precious rubies. They have made a deal with UK multinational Gemfields, which pays General Raimundo Domingos Pachinuapa a percentage of every ruby sold, as long as he keeps locals in line. Pachinuapa has destroyed farms to clear the way for corporate mining and rendered artisanal miners unemployed. Samora Machel, the son of former president Samora Machel, sits on the board of Gemfields, as do many Frelimo bigwigs, according to AIPC and Africa Confidential.

In the Democratic Republic of Congo (DRC), President Joseph Kabila runs a ramshackle administration whose very inefficiency proves to be efficient for his type of plunder. His enormously wealthy sister, Jaynet Kabila, has an offshore account in Panama, and holds more mining licences than is allowed under DRC laws.

President Kabila appointed former justice minister Luzolo Bambi as the DRC’s “special anti-corruption advisor” – who, AIPC’s report says, doesn’t pay tax. A development project in Rwanda, meant to advance farming in the country, paid a bargain price for unhealthy cows from the Netherlands, even though farmers preferred to source more acclimatised livestock from South Africa.

The deal was a disaster, facilitated by the ruling party’s business vehicle, Crystal Ventures, which holds interests in almost every sector of the economy.

The country’s strongman, President Paul Kagame, who holds shares in Crystal Ventures, rules the country with an iron fist, and many allege that he has used assassination to eliminate opponents.

Neighbouring Burundi is not as economically successful as Rwanda, but its rulers aren’t any less poor. The tax-revenue agency has been captured by the president’s inner circle, according to Burundi’s corruption watchdog Olucome, and state revenues are underreported. While anti-corruption agencies abound, there is little law enforcement. The country’s judges, many of whom bought their positions, have no interest in the rule of law.

Botswana makes most of its money from diamond mining and tourism centred on the Okavango Delta. President Ian Khama holds shares in divisions of Wilderness Safaris, a conglomerate that runs about 70 luxury lodges in the delta, earning about $200m every year – none of which goes to Botswana. All of this is made possible by a complex network of subsidiaries and crossholdings that make up the Wilderness Safaris group.

President of Togo, Faure Gnassingbé Illustration: Vusi Malindi

Why do they do it? Various theories have been offered to explain the plunder. Some are sociological, others economic, while some take a more psychological slant. Nkwazi Nkuzi Mhango, in his Africa’s Best and Worst Presidents (reviewed in AIF, July 2017) seems to favour a psychological explanation: he says tyrants suffer from “small-man syndrome”.

Mhango’s analysis makes no distinction between dictators, differences in their style and methods, and lacks sociological rigour. The neo-patrimonial school of thought has put forward the dominant paradigm, which proposes a failed transition from tradition to modernity. Described as a “debilitating witch’s brew”, neo-patrimonialism sees state resources used to buy loyalty from sectors that prop up regimes.

These analysts point to several features of African societies: a failure to develop a sense of “public good” or “universal interest”; untoward deference to authority; a tendency towards consumption rather than savings and investment; dependence on a “clientelism” patronage system and a consequent low savings rate; and rule by insatiable, gluttonous “big men” with excessive sexual appetites, who fear the emergence of rivals and resort to drastic measures to ensure a single centre of power prevails.

University of Cape Town development economist Thandika Mkandawire critiques this approach, arguing that it lacks specificity, has little explanatory value, is “plagued by non sequiturs” and informs the misguided policies of aid donors.

These theories, he says, have the effect “of flattening the African political and economic landscape – often rendering monochromatic the many colourful and varied characters who have taken the African political stage over the past half century”.

Patrick Bond, a political economist at the University of the Witwatersrand in Johannesburg and author of Looting Africa, proffers the Marxist explanation advanced by Frantz Fanon. Post-independence states, he says, were structurally prevented from producing African middle classes, the bedrock of capitalist societies, and were set up to fail.

Says Bond: “Instead of an organic middle class and productive capitalist class, Africa has seen an excessively powerful comprador ruling elite whose income has been based upon financial-parasitical accumulation, which in turn is subject to vast capital flight.”

International networks – corporations, states and geopolitical players – prop up the oligarchs, despite their looting, and continue to trade with them. Behind a veneer of legality, the former colonisers and their multinational companies facilitate looting.

Thus, governance becomes a matter of continuous and never-ending crisis management. Budgets are never adequate, while economic exploitation exacerbates the persistence of neo-colonial inequalities. Neo-liberalism has further wrecked the post-colonial scene, through the structural adjustment programmes of the 1980s and 1990s.

Creditor nations extract conditions that beggar the indebted countries and render them liable to forms of blackmail, which is then used to privatise sectors of the economy, which are snapped up by multinational companies. African dictators inherit polities largely devoid of institutions that regulate governance, giving leaders unfettered power.

General Raimundo Domingos Pachinuapa, former Frelimo leader, Mozambique Illustration: Vusi Malindi

Treasuries become banks to fund patronage and even initially well-meaning rulers become centres of patronage networks. Once these take shape, they develop their own logic, demanding attention for this or that looting project to maintain a volatile balance of power at the expense of developmental imperatives.

Despite the unconvincing nature of psychological explanations, we have to acknowledge that even structural explanations assume subjects who are susceptible to the machinations of corrupt networks, though this is not strictly a personality type. Bond does not paint a picture of the looter but we can extrapolate from his structural explanation, relying on Fanon.

The looter’s deadly sin, greed, is exaggerated by the (relative) poverty of the post- independence colony.

Once a dictator is in place and he (rarely a she) amasses wealth, there is hardly anything in his own society to amuse and satisfy him. Looters can do little with “their” money on their continent and the hobbled middle class is unable to take up the challenge of promoting economic production.

Looters have no incentive to spread wealth by creating productive enterprises, even if they might benefit. As they see it, if others benefit, rivals might emerge. Instead, money is channelled off continent, because keeping it in local banks would draw attention. And it is also useful to keep the money where it can be spent.

Surrounded by the misery of millions in poverty-stricken urban and rural slums, the looters establish bases in first-world cities; Paris, London, New York, Geneva and Lisbon are the destinations of choice. Now, there is also Dubai – and, of course, Panama.

Only the ruthless make it to the upper echelons, and once there they suppress the development of institutions that would enable good governance. A vicious circle ensues.

Within these dysfunctional societies, individuals grappling to save themselves are always available to do what oligarchs are required to do – if the society doesn’t work, you look after yourself and your loyalists, and your family and your tribe.

Despite the gloom cast by these findings, there are moves to clamp down on tax havens, to repatriate stolen funds, and push legislation

to make banks wary of shady depositors.

President of DRC, Joseph Kabila Illustration: Vusi Malindi

Richard Brooks, author of The Great Tax Robbery, who worked on the Panama exposé, argued in the Guardian: “To tackle the cancer of corruption at the heart of the global financial system, tax havens need not just to reform but to end.”

Oligarchs are being found out, and the AIPC report is one of a string of revelations that testify to the resolve to combat corruption. Journalists and researchers are unearthing the facts, defying even the most brutal regimes, giving activists the knowledge to take up the fight for clean government and decent living conditions.

More hopefully, ordinary people are rising up across the continent. Buoyed by activists, they resist their silencing and degradation, in turn inspiring institutions to take up their regulative roles.

Not all the judges have been paid off: the Kenyan judges who nullified the flawed elections last year weighed in on the side of the people. The vicious circle is being broken. The days of the African oligarchs might well be numbered.