The impact of climate risk on investment portfolios is overblown, and investors should not worry. After all, some madman always screams about the world’s end, which has not ended yet. Stuart Kirk, former Global Head of Responsible Investment at HSBC Asset Management, made these points in a presentation titled “Why investors need not worry about climate risk“.

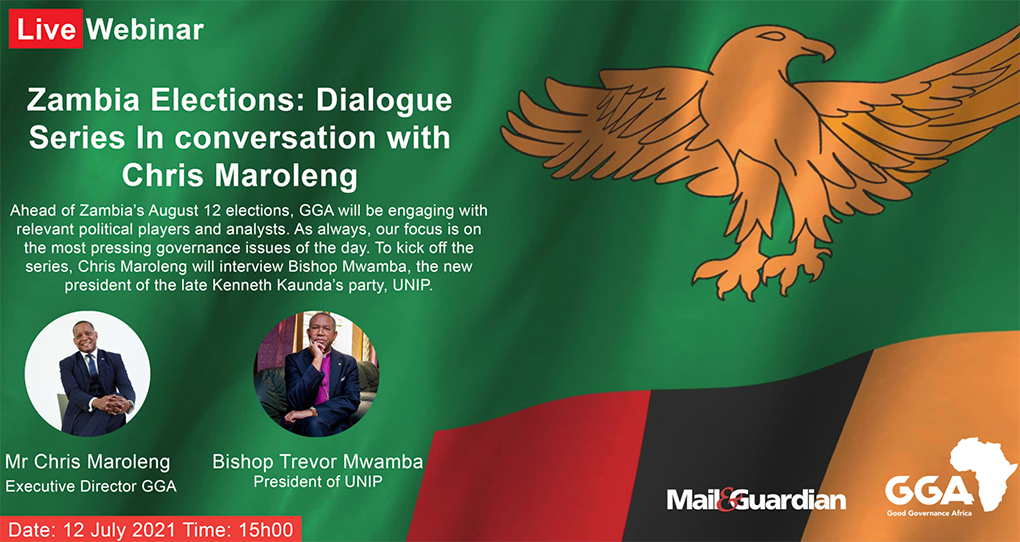

A fire fighting airplane sprays water to extinguish a wild fire on Mount Geraneia, west of Athens, on May 22, 2021. The homes and businesses consumed in the wildfires, the impending insurance claims, and the loss of human life bear witness to the financial cost of climate change. Photo: Yorgos Kontarinis/Eurokinissi/AFP

Several investors, executives, politicians, and asset managers share this view. They condemn the obsessive focus on climate risk, and the environmental and social impacts of doing business, which inform Environmental, Social Governance (ESG) integration. To some, ESG and sustainable investing are scams akin to selling indulgences to assuage guilt and signal virtue. To others, it is a plot by left-wing radicals to destroy the energy industry from within and inflame the culture wars. After all, a house divided against itself cannot stand.

Significant climate events do not occur everywhere at the same time. As a result, the implications of climate risk on investment portfolios are not equally visible worldwide. Unfortunately, due to the interconnected nature of the planet, these events increase the risk and fragility of the global economy. Climate and environmental risks are not the only ones confronting the global economy. Social risks such as inequality, human rights abuses, and political instability can disrupt the global economy. Effective and transparent governance must occur in the government and private sector to enable shared value and sustainable development. These lie at the core of ESG.

Within this context, a new(er) normal confronts the global economy. The new(er) normal is the fruit of an unholy union between supply chain issues, rising global inflation, and an energy crisis. The surrogates are the increasingly visible impacts of climate change and the urgent action needed to address it. The new(er) normal exemplifies the financial risks of inaction for the current economic system.

In Europe, heatwaves and wildfires destroy property and kill hundreds. The homes and businesses consumed in the wildfires, the impending insurance claims, and the loss of human life bear witness to the financial cost of climate change.

At the same time, Russia’s invasion of Ukraine is upending global energy markets, unbalancing energy security, and causing high energy prices. This has led the European Union (EU) to rethink its energy policy. Similarly, the invasion of Ukraine has also contributed to high food prices due to Russia and Ukraine being major wheat exporters and Russia being a significant exporter of fertilizer.

Lastly, regulatory challenges and opposition to environmental management policies have become increasingly common. In the United States, the Supreme Court ruled to limit the powers of the Environmental Protection Agency (EPA) to reduce carbon emissions from power plants. Some politicians have suggested that a carbon tax or stricter emissions management would result in consumers paying significantly more for goods and services.

The new(er) normal presents ESG with a question – Can sustainability and environmental needs be balanced against the social needs of people? I believe it is possible. However, doing so requires a more significant emphasis on the ‘S’ and ‘G’ dimensions of ESG. These two concerns of ESG are ones that, at times, find themselves in conflict with environmental concerns. For ESG to be able to confront the new(er) normal, it must deal with some of the criticisms levied against it.

Robert Armstrong and Tariq Fancy have criticised ESG for being a dangerous distraction. Moreover, they highlight the misalignment between incentives of asset managers and timelines needed to address ESG-related issues. Instead of taking the necessary actions needed to address society’s challenges, and changing the way of doing business, ESG presents itself as the solution to society’s systemic issues. Both have also argued unelected individuals, such as Larry Fink, CEO of BlackRock Investments, are not the proper vehicle to address society’s challenges. For them, the correct way is through the ballot box, through voters selecting their elected representatives.

Effective regulation is essential to internalise the costs and challenges of the current way of doing business. Armstrong and Fancy stress the need for a carbon tax on companies. However, their argument about misaligned timelines could also replace asset managers and executives with politicians. While asset managers focus on quarterly bonuses, politicians focus on the next election and increasing their power. Similarly, while the loan book for an asset manager may be for six years, the electoral cycle is every 2-6 years in the United States. While Fancy and Armstrong are right about the crucial importance of regulation to direct corporate actors along a sustainable path, the partisan interests of politicians make the passage of climate-related legislation difficult in some countries.

Source: United Nations Sustainable Development Goals

Source: United Nations Sustainable Development Goals

For ESG to have a positive impact, practitioners and politicians must look more closely at the United Nations Sustainable Development Goals (UN SDGs). The SDGs present a set of goals to be achieved by the world by 2030. These include eradicating global hunger, ensuring affordable energy security, and improving access to healthcare. ESG and SDGs are two perspectives on sustainability. SDGs approach broader societal-focused goals, and ESG focuses on how corporate entities approach sustainability. The current focus on ESG is mostly on the ‘E’, the incorporation of SDGs offers an opportunity to raise the profile of overlooked ‘S’ issues.

Prioritising the achievement of the SDGs in ESG integration is a chance to integrate ESG into policies that meet the demands of the moment, especially where there are seeming contradictions between different elements and goals. High inflationary pressure leads to reserve banks increasing interest rates. Higher interest rates suggest that companies will reduce the number of workers employed as part of their cost-cutting mechanisms. Increased unemployment means that more individuals will fall into poverty. This will damage and hinder the achievement of SDG 8: Decent work and economic growth – having knock-on effects on other SDGs, namely 1, 2, 3, 4, 5, and 10. In essence, the market doing what it naturally does would worsen the systemic social ills ESG attempts to internalise.

Greater incorporation of the SDGs as a crucial framework for reporting around ESG addresses Armstrong and Fancy’s criticism of unaligned timelines and contrasting incentives. The SDGs present a clearly defined timeline for achieving a goal, enabling the quantifiable measurement towards this end. Prioritising the SDGs in ESG does not mean that one should reduce environmental considerations. Indeed, the SDGs are compatible with a focus on reducing emissions, as reduced emissions will directly improve the attainment of several SDGs. However, the SDGs are human-centred in their efforts to make a better future.

The impact of climate risk on investment portfolios is not overblown. The effect of social risks is severely understated. Climate change is a significant threat to the global economy and humanity. However, so too are poverty and inequality. Greater integration of the SDGs presents an opportunity for ESG to internalise the costs of the economic machine and our push towards a greener future.