African airlines: the good and the bad

A history of government interference in African state-owned airlines has led to inefficiency and unsustainable debt levels, but Ethiopia’s done it differently

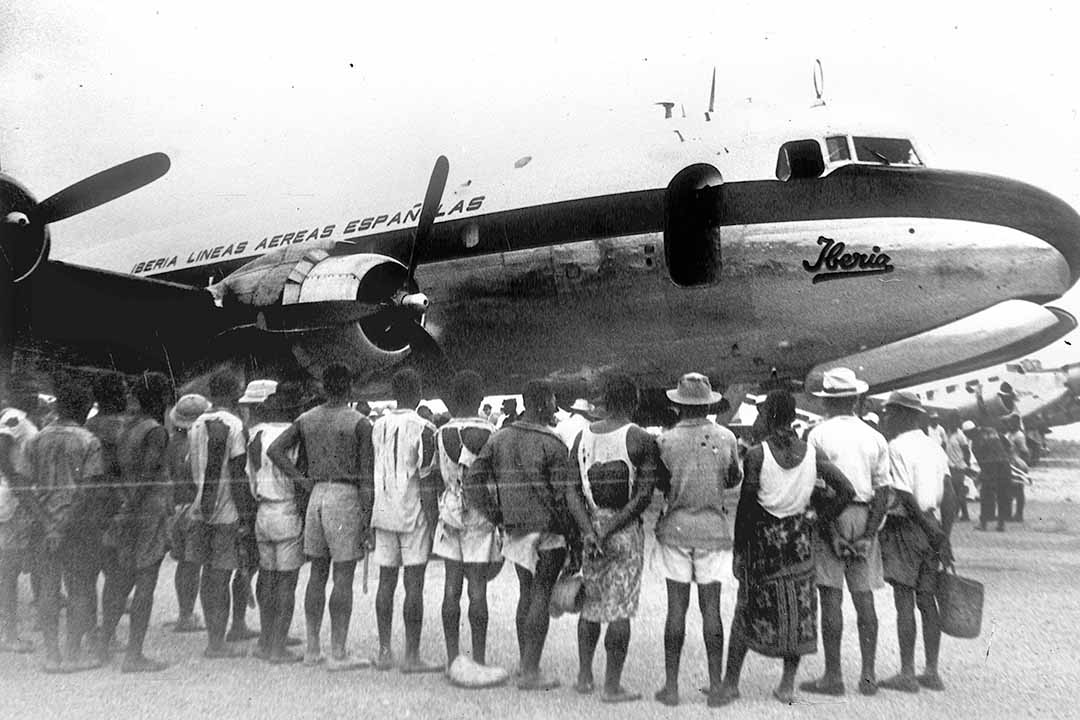

Running an airline is a complicated and expensive business. Pundits argue it is best left to those who know what they are doing. But governments across Africa seem to disagree, with most refusing to relinquish the reins of state-owned enterprises and, in most cases, compromising their ability to succeed. The African aviation space has been dominated by state-owned airlines over decades, and the continent is littered with the carcasses of many that have crashed and burned. Ghana Airways (1958-2004), Nigeria Airways (1971-1993), Zambia Airways (1964- 1995), Uganda Airlines (1977-2001) and Air Afrique (1960-2002) were just some of those that didn’t make it. However, there have been some exceptions. South African Airways (SAA) is one of them. In its heyday, it benefited from regulatory measures that afforded it the pick of routes and it was once regarded as the “high-flier” of African aviation, sought after by passengers travelling around the continent.

Its service was professional and safety record solid. But years of poor leadership, political meddling and overspending have eroded its advantage. By 2019, the airline had pulled back on many loss-making routes, and it was surviving on large taxpayer-funded bailouts. Another exception is Ethiopian Airlines, which has slowly and steadily become Africa’s biggest carrier, serving nearly 60 destinations in Africa, compared to SAA’s 25, and more than 100 cities on five continents. In its 2016-17 financial year, it generated $2.7bn in revenue, up 11% from the previous year. Passenger numbers rose by more than 18%. State ownership has been the kiss of death for most African airlines. National flag carriers continue to be desired in Africa by governments regardless of the cost of running them. Though they are regarded as a proud symbol of statehood to be maintained at any cost, most have ended up in the ashes, brought down by substantial financial losses.

African airlines have also historically battled to compete with European carriers and, since the 1990s, Middle Eastern airlines with deep pockets and an eye on the underserviced African market. In addition to the examples above, a few others have survived. Air Zimbabwe, launched in 1967 as Air Rhodesia and renamed Air Zimbabwe after independence in 1980, has done so against the odds. It has all the hallmarks of failure but the government refuses to let it die. Kenya Airways, founded in 1977, is another. It was privatised in 1996 but has battled to build on its position as a leading African airline, a weakness compounded by the aggressive push into the continent by international airlines, one of which was a key stakeholder – KLM. Its financial woes led the Kenyan government to announce in 2019 that it planned to nationalise the airline to rescue it from bankruptcy.

With SAA cutting back routes and raiding the fiscus to survive while Ethiopian thrives, the obvious question is what are the factors that have led to such divergent outcomes for these airlines? Why has Ethiopian been able to make state ownership work for it and SAA not? There are several reasons to consider. One is history. For all its success today, Ethiopian Airlines had a turbulent past rooted in its country’s challenging political and economic fortunes. Its management spent the better part of the 1980s and 90s fending off aggressive state interference in its operations. Political meddling brought it to the brink of bankruptcy. But, ironically, this experience has served it well in later years, creating a resilient and problem-solving management that remains focused on maintaining the carrier’s hard-won autonomy and allowing it to run the business as a commercial enterprise. The government does, however, retain an oversight role through a presence on the airline’s board.

SAA, state-owned for more than 80 years, had a comparatively easy ride, with guaranteed market dominance until the 1990s that put it well ahead of later competition. But instead of building on this early advantage, it has been weakened by poor leadership and overzealous expansion efforts. Management stability and performance has been compromised by increasing political meddling in later years, as it was with Ethiopian in the early days. Ethiopian Airlines has been constant but careful in its expansion, particularly in fleet upgrades. SAA’s current problems are said to have gained impetus with a big push into the African market in the late 1990s by the then CEO, American Coleman Andrews. The airline spent lavishly on fleet expansion to underpin this expansion plan, and sold off a stake in the airline to Swissair to give it access to Swissair’s then-extensive network within Africa and Europe. But by 2002, SAA had suffered massive hedging contract losses. Moreover, Swissair went bankrupt, forcing SAA to buy back its stake.

SAA also battled to build links with other African carriers. Its attempts to set up regional airline Alliance Air in East Africa and establish joint ventures with Nigeria Airways and Uganda Airlines were unsuccessful. Plans to establish a hub in West Africa never materialised. Ethiopian has always prioritised the African market, with a view to positioning itself as a hub for traffic into international markets. The airline has managed to build solid relationships with other African carriers to pre-empt rivals eyeing Africa and to provide secondary feeder hubs for the airline into the main hub in Addis Ababa. The country, a proponent of greater African unity, has put itself in pole position for a new push for intra-continental trade by providing an ever-growing network of air links. A stable, visionary and disciplined management is another factor that separates the fortunes of SAA and Ethiopian Airlines. SAA has had nine CEOs in the decade from 2009.

The revolving door of CEOs was almost matched by a similar trend in key government ministries such as finance. These changes undermined the potential success of turnaround strategies, which were almost as numerous as the CEOs. Mostly, the executives were brought in from outside the airline, lacking the requisite skills and history to counter political meddling. This was at its height during the 2009-2018 tenure of former president Jacob Zuma, whose close friend Dudu Myeni was appointed chair of SAA in 2012. Myeni presided over years of mounting losses, wasteful expenditure and procurement fraud, becoming untouchable until her removal in 2017. During this period, Ethiopian Airlines was run by experienced hands who had grown their careers within the airline. One of these is current CEO Tewolde Gebremariam who has been there for the best part of 30 years. Since becoming CEO in 2011 he has steered the airline through its greatest period of growth.

Ethiopian Airlines has prioritised cost containment, which underpins its long-term business plan. It has also successfully cross-subsidised passenger services with revenue-generating businesses that support its core operation and give it greater control of costs. These include the establishment of training academies, an aircraft maintenance centre and an in-house catering business, which are now core to its operations. Ethiopian’s cargo operation is now the biggest in Africa. In the case of SAA, cost issues appear to have been overtaken by political expedience. Now its extravagant spending and its inability to implement a sustainable, long-term plan have led it to the brink. Its other services, such as SAA Technical and Air Chefs, contribute little to the bottom line – 2.29% and 0.41% respectively in the 2016-17 financial year. SAA’s freewheeling expenditure on free tickets for civil servants does not exist in the Ethiopian stable.

Moreover, the South African airline is vastly overstaffed but held hostage by militant trade unions that are steadfastly against privatisation and staff cuts. SAA also has growing domestic competition; by 2017 its domestic market share had declined from 98% in its heyday to about 23%. With both SAA and Kenya Airways in trouble, Ethiopian Airlines is likely to continue its dominance of the African skies, but it is not without challenges. One is managing its rapid growth, which is having an impact on service delivery. It also needs to bed down its new African acquisitions and ensure these airlines add value rather than drain resources. But SAA remains a force in Africa’s aviation landscape. It has a fleet of 64 aircraft, 10,000 staff and flies to 25 regional destinations and eight cities outside Africa. Its demise would not be good for already patchy connectivity in Africa and passenger convenience. With a business-friendly president in place and professional ministers now in key posts, SAA’s $2bn turnaround plan may gain some traction.

Analysts have urged the airline to follow the Ethiopian model. Researcher Andrew Barlow, writing for the Helen Suzman Foundation, says: “The lessons for SAA’s shareholder are manifold and yet straightforward and easy to implement. An entirely new board should be appointed with a mandate to operate along business lines. The senior management team should be strengthened by the appointment of people with industry experience, who can develop the strategic vision to take the airline forward as a business. Then allow the managers the freedom to do their jobs. It’s not complicated.” Brenthurst Foundation Director Greg Mills echoes this sentiment. “The [Ethiopian] airline’s formula is quite simple,” he says. “They have a plan, they are cost conscious, and they are constantly exploring new routes and partnerships. In South Africa there is little appetite for doing things properly.”

The lesson Ethiopian Airlines offers is not necessarily how to run a successful state owned business. Rather, it highlights the importance of having a strategic plan and the willingness to implement it without having to pander to political expedience in what is already a tough operating environment.